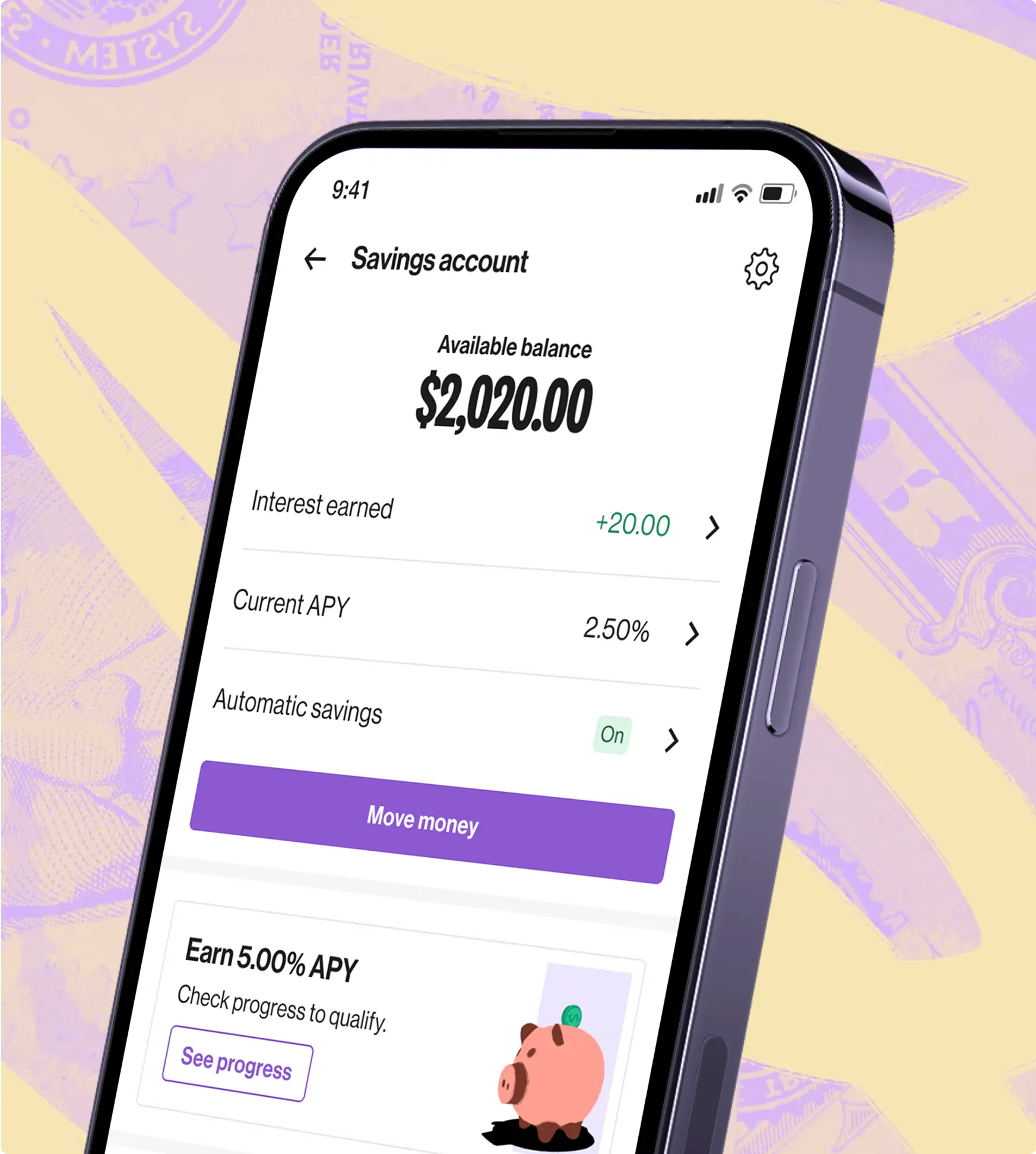

Open an online savings account¹ with no minimum balance, zero fees, and automatic savings tools. Get a savings interest rate of 2.50% Annual Percentage Yield (APY) immediately, with a simple path to higher-interest savings of 5.00% APY¹. Quals apply.

Online savings account

A FASTER WAY TO SAVE MONEY.

Savings account features

Everything you need to reach your goals.

Instant 2.50% Interest Rate

Level up your interest rate.

Earn 2.50% APY on every dollar when you open an online savings account with Varo and rake in 6x the nation average², plus no minimum deposit, savings limit, or monthly or annual fees.

Automatic savings tools

Put your money to work without lifting a finger.

Our savings account doesn’t just earn you 2.50% APY—you also get access to automatic savings tools that take the stress out of saving. Just set it, forget it, and watch your money multiply.

Save Your Pay®: Choose how much of your direct deposit is automatically transferred into savings (up to 100%).

Save Your Change: Opt-in to automatically round up to the nearest dollar on every purchase and transfer the difference into your Varo Savings Account. You can opt-out at any time.

No fee savings account

No fees. No minimum balance. No brainer.

It’s easy to grow your money when you open an online savings account with Varo. There are no minimum balance, annual, or monthly maintenance fees. Which adds up to more money in your bank account, for you.

High interest savings accounts

Grow your money faster with 5.00% APY

Varo’s high interest savings rate can help your hard-earned money work even harder for you. Get up to 5.00% APY on your first $5,000 and 2.50% APY on everything else. Just have $1,000 in direct deposit a month and maintain a positive balance in your bank and savings accounts to continue qualifying.

Free mobile banking

More money in your pocket, month after month.

Without branches, Varo cuts costs and passes the savings on to you. Get 100% free mobile banking, instant money transfers, in-network ATM withdrawals³, and cash deposits at CVS®⁴.

Loans and optional services have fees.

Secured and insured

FDIC® Insured.

For real peace of mind.

Every cent deposited in your Varo Savings Account and Bank Account is insured by the FDIC up to $250,000, so you know your hard-earned cash is safe and sound. To learn more about how Varo keeps your money and personal information safe, see our Security and Control page.

MOMENTS OF PROGRESS ⁵

GET THERE FASTER. START SAVING TODAY.

Open a savings account online in less than two minutes. No hard credit check needed to apply.

Savings Account FAQs

What are the requirements to open a savings account online?

How do I activate Save Your Pay®?

How do I activate Save Your Change?

Is there a limit to the amount of savings that can earn the 2.50% interest rate?

How can I qualify for the 5.00% APY high-yield savings interest rate?

The first step in gaining access to your Varo Savings Account is to first open a bank account online with us. Applying won’t impact your credit score.

To open a bank account with Varo you must:

Have access to a device that can run our app and an active email account. Check out our system requirements for more information.

Be able to verify identity—see accepted verification methods.

Be a U.S. Citizen or Permanent Resident (residing at a physical address) within the fifty (50) United States or the District of Columbia.

Be 18+ years old.

Note: Only one bank account per customer. Accounts must be individually owned. Joint accounts, secondary debit cards, and business accounts aren't currently supported.

It may take up to 3 business days to receive a final decision once your account application is submitted.