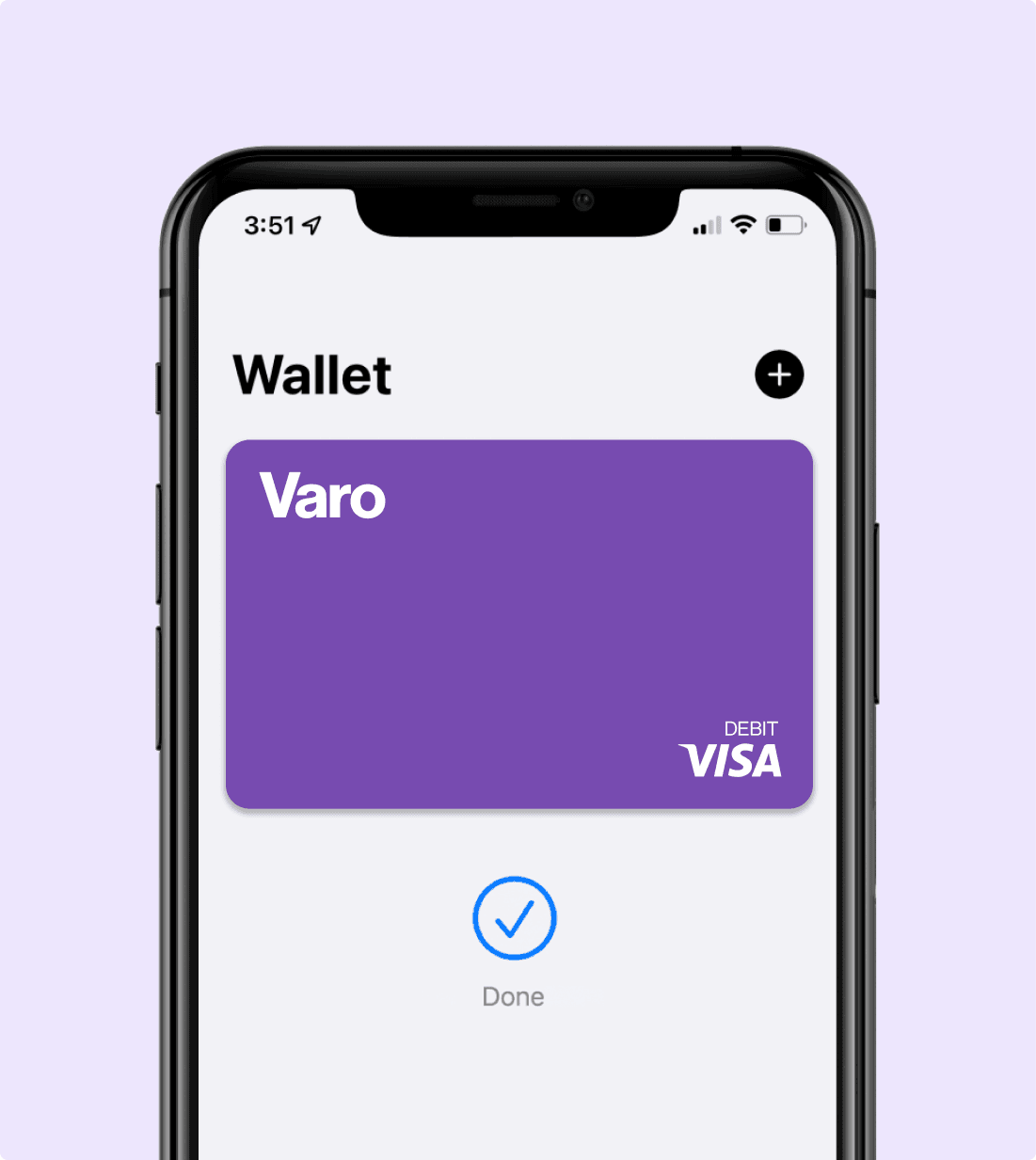

Open a bank account and you get a nice bonus: a Varo debit card. Even better? There are no hidden fees and you can use it online instantly.²

Varo Debit Card with no hidden fees

VARO DEBIT CARD. NO WEIRD FEES.¹ INSTANT ACCESS.

Instant access

Forget waiting. Use your card right away.

It’s a digital card in a digital world. Which means you don’t have to wait around to start using it. All you need to do? Move money to your account in the app. Then just start spending using your digital card in your Apple® Wallet or Google® Wallet.

No crazy fees

No sketchy bank fees.¹ More money for you.

No monthly fees. No card fees. No minimum balance. We got rid of all those sketchy fees that big banks charge. Ya know, the ones chipping away at your balance? Your money is your money. And we want to help you keep it that way.

Fee-free ATMs

40,000+ Fee-free ATMs. Take your pick.

When you get a Varo card, you get free access to over 40,000 Allpoint ATMs.³ So think blocks, not miles to find cash fast. We’ve even got ATMs at stores you love: Walgreens®, CVS®, and Target®.

Security & Protection

Take control and secure your cash. Right on your phone.

Lose your debit card? No sweat. Lock it instantly from your Varo app and request a new one through the Varo app— we’ll send you a free replacement. What’s more, your card’s Visa Zero Liability⁴ policy protects you from any unauthorized charges.

Save Your Change

Save with every swipe.

Turn on our automatic saving tool to save a little whenever you spend a little—and grow your savings a lot. Whenever you use your debit card, we round up to the nearest dollar and transfer the spare change from your Bank Account to your Savings Account. It’s that easy.

Activate your digital debit card.

1. Open the Varo app, and look for the “Early access to your card” screen.²

1. Open the Varo app, and look for the “Early access to your card” screen.² 2. Tap “Yes, I want early access”

2. Tap “Yes, I want early access” 3. Move money

3. Move money 4. Start spending!

4. Start spending!

GET YOUR DEBIT CARD TODAY.

Signing up for an account takes less than two minutes. And there’s no impact to your credit score.