Make the most of every dollar with a free online bank account that helps you avoid fees while getting paid early¹. Reach your money goals faster with free cash deposits², automatic savings tools, and cashback at select merchants³.

Your Free Bank Account to Get Ahead

YOUR MONEY CAN DO MORE FOR YOU.

Features of our free bank account

Everything you need from your bank.

Fee-free cash deposits

Deposit cash for free at CVS®

No bank branch? No problem. Now you can easily deposit your cash fee-free at over 7,500 CVS locations nationwide2.

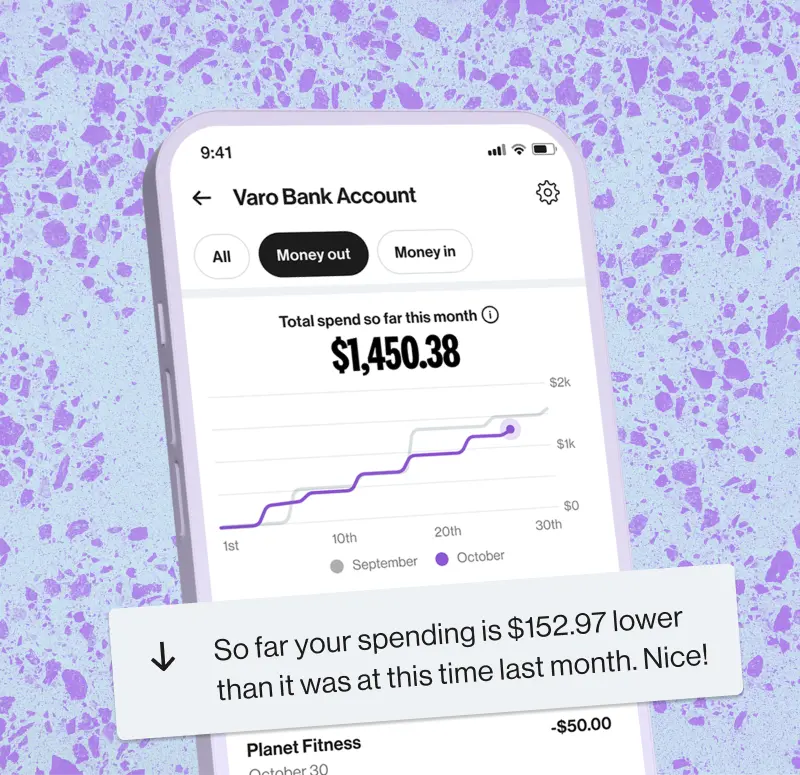

Personalized financial insights

Budget even better with a smarter bank account.

Track your cash flow daily and see it broken down into different categories within the last two months—all in one easy place.

Named as an 'Innovative App Feature Pushing the Mobile App Experience Beyond Transactions' by The Financial Brand5.

Download Varo

4.9 stars

250k reviews

A truly free online bank account

No sketchy fees. Period.

That’s right.

No monthly fees

No overdraft fees7

No minimum balance required

No in-network ATM fees6

Free cash deposits at CVS2

Whether you’re a student, a parent, or simply looking to get ahead, our free online bank account helps you keep more of your money.

See complete list of fees for optional services here.

Early direct deposit

You deserve to get paid faster.

Get paid up to two days early1 at no additional cost. Do what you want with your money, even sooner.

In-network ATMs with no fees

More than 40,000 ways to get your cash. Fast.

With Varo, finding cash when you need it is more convenient than ever. The U.S. Allpoint ATM network has more than twice the free ATMs6 offered by individual big banks8. Stick with us and skip the fees.

Member FDIC

Insured & secured with the FDIC.

What’s precious to you is precious to us. Don't rely on money apps who stash your cash with third-party banks. We're a legit, nationally chartered bank, so you can count on your money being FDIC-insured for up to $250,000—directly with us.

Sign up in less than two minutes.

Download the app.

Download the app. Apply for your free bank account.⁴

Apply for your free bank account.⁴ Add your card to your mobile wallet.

Add your card to your mobile wallet. You’re on your way.

You’re on your way.

In the press

MOMENTS OF PROGRESS ⁹

DO MONEY THE WAY YOU WANT.

Sign up for Varo in less than two minutes. There’s no impact on your credit score.

Bank Account FAQs

Is Varo a real bank?

Does Varo have physical branches?

What do I need to open an account?

How do I apply for an online bank account?

How do I make deposits or withdrawals?

YES. While most money apps store your money with third party banks, Varo was the first fintech to be granted a national bank charter by the OCC. By banking with us, you not only get the benefit of innovative fintech app features, but also have peace of mind knowing that your money is protected by FDIC insurance up to $250,000, directly with us.