Start banking better today.

Quick cash advance

Cash Advance will spot you. Seriously.³

When the unexpected happens, you can get up to $250 right away by linking a qualifying account. It’s easy to use, has no interest, and simple, flat fees. Set up direct deposit and build your borrowing limit up to $500³ over time—one of the biggest advance amounts.⁸

ⓘ Flat fee applies based on loan amount; fees range from $1.60-$40. Quals apply.

Line of credit

Skip the BS and borrow up to $2,000.¹

Receive your money in just seconds once approved. The best part? No subscription fees, no late or hidden fees, and affordable monthly payments. Quals apply.

Banking with no surprise fees

MONEY SHOULDN'T COST YOU A THING

Automatic cashback

GET 3% CASHBACK⁹—OR MORE!

Earn cash automatically at over 10,000 merchants nationwide. No sign up required. Just shop and earn.

Direct deposit

EARLY PAYDAY.² ‘NUFF said.

Up to two days early. That's how fast you can get your paycheck with direct deposit.² Plan your budget, treat yourself, take care of that bill—the cash is yours.

Up to 5.00% Annual Percentage Yield (APY)

Get your savings high. Like, really, high.

Got big money dreams? Grow your savings faster with one the highest savings rates in the country.¹⁰ That’s right, qualify for up to 5.00% APY on up to $5,000 and earn 2.50% APY on everything else.⁵

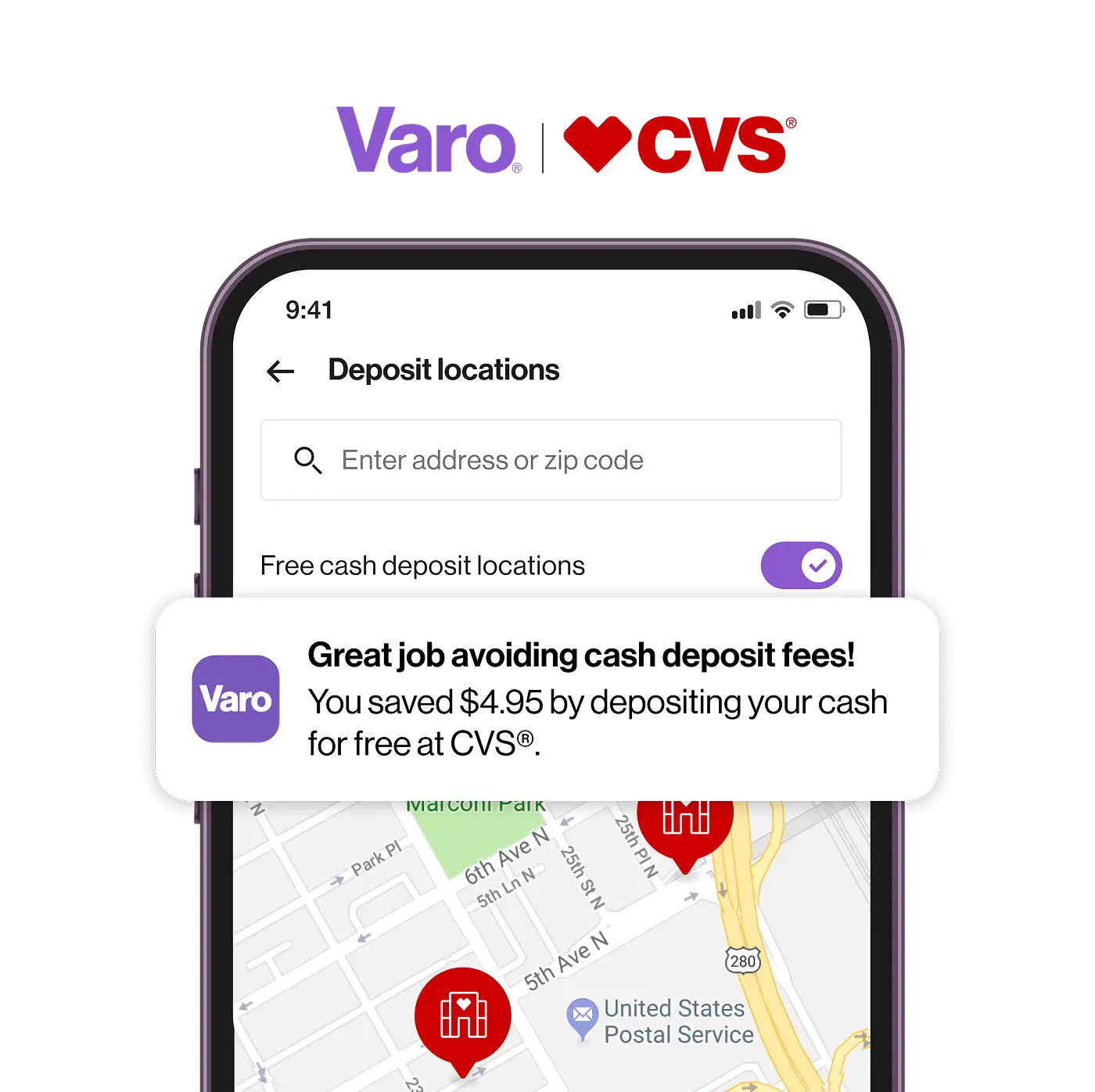

Fee-free cash deposits

Deposit cash for free at CVS®

No bank branch? No problem. Now, you can easily deposit your cash fee-free at over 7,500 CVS locations nationwide.¹¹

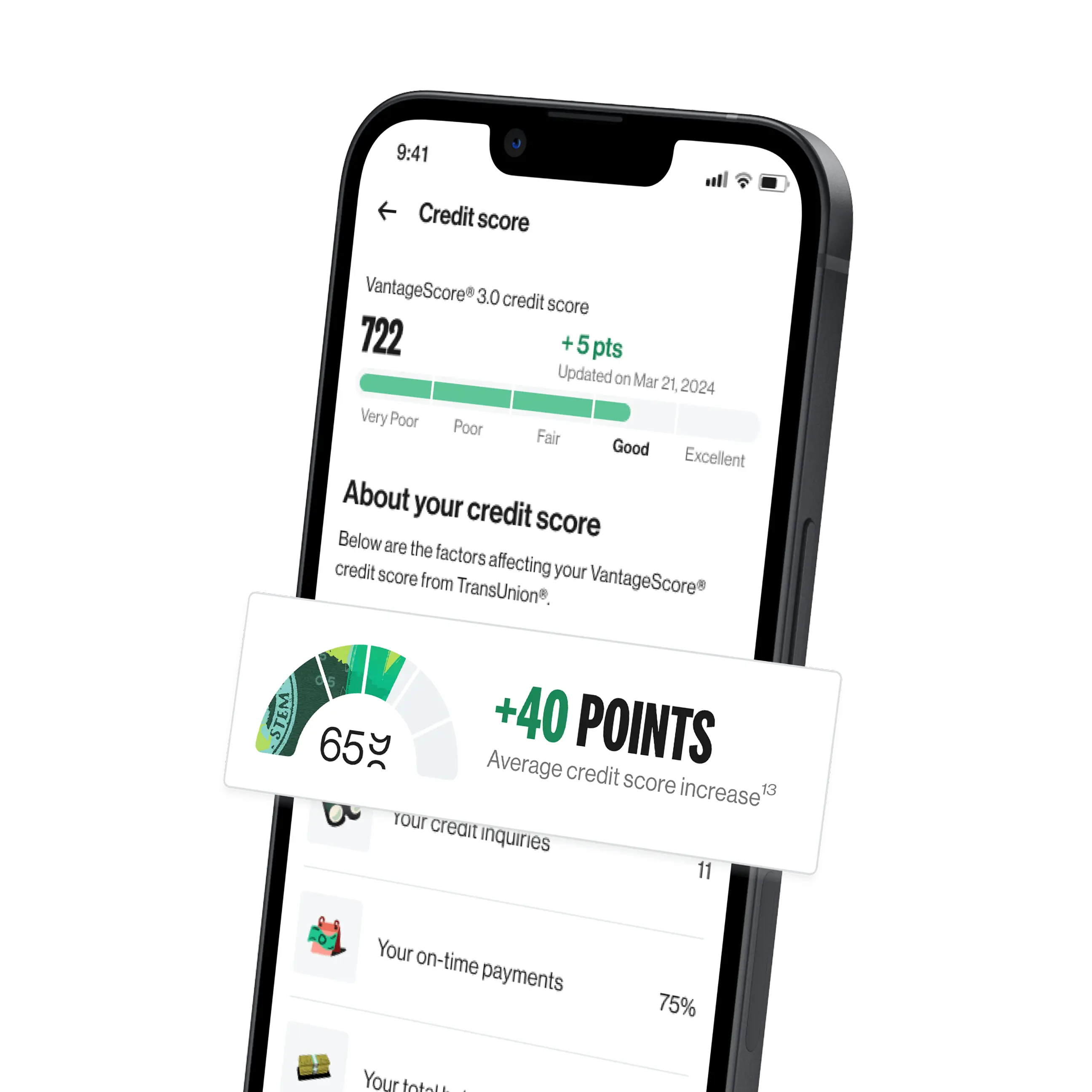

Grow your credit score

BETTER CREDIT STARTS HERE.

Take the first step and start tracking your credit score for free in the Varo app.¹² Then, you can easily help build your credit with the Varo Believe Visa® Credit Card⁴ on everyday purchases.

On average, customers see a 40+ point increase after 3 months of on-time payments when using the Varo Believe Visa Credit Card.¹³

MOMENTS OF PROGRESS¹⁴

Security & FDIC insurance

Security & FDIC insurance

Your money is seriously covered. Up to $250,000, to be exact. Not only are your deposits FDIC-insured, we’re also an independent bank with our own banking charter.

MAKE YOUR MONEY DO WAY MORE.

Signing up takes 2 minutes.